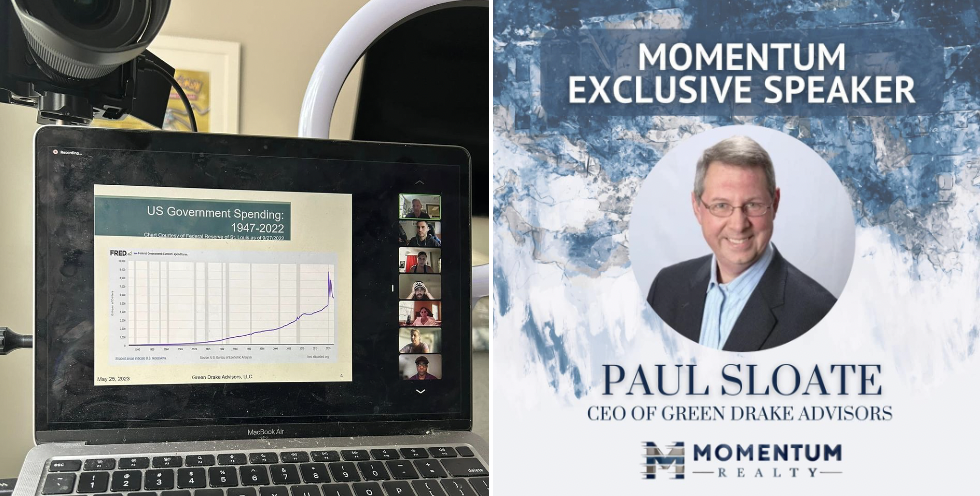

Momentum Exclusive Speaker - Paul Sloate, CEO of Green Drake Advisors

Paul Sloate is the CEO of Green Drake Advisors. He is a Cornell/Wharton graduate who runs this Registered Investment Advisor (RIA) with other partners who cumulatively have more than 60 years of giving financial advice. Paul invests in many start-up companies, and is actively sought out to sit on companies' board of directors.

He spoke to our Momentum Tribe on market conditions, entrepreneurship, and how to position ourselves to win in this new economy.

Here are my rough notes from our very valuable call - not word for word, but filtered through my lens.

Notes from Exclusive Speaker Paul Sloate, CEO of Green Drake Advisors:

Existing homeowners are reluctant to give up their interest rates (it’s viewed as an asset now). High interest rates have been good for builders, but not good for the housing market.

Jan 2022 - fed started raising rates, housing is on the front end of interest rate hikes, everything else has more of a lag.

Fed controls the speed limit of the economy and adds the financial grease to grease the wheels of the economy. The fed creates the business cycle.

We have very low tax rates on a historical basis, almost as low as the 1920s.

We are running a high budget deficit

You cannot have low tax rates and high budget deficits, this is unsustainable.

After the next election, taxes will go up across the board for everything, and that will impact housing and the ability of people to purchase a house.

Debt to GDP is higher than it was in WWII, typically when debt is out of control governments get rid of it through inflation. We expect inflation to be the primary mechanism to get rid of its debt.

The fed will probably accept inflation in the 3-4% rate instead of the 2% target. The economy will need to grow faster because it is in a huge competition with China. We will need to spend more on defense. We will have inflation, more money printed, and more taxes.

Anytime treasury bill rates have risen this much, we have ended up with a recession. There is a recession in the US future. Lags are difficult to predict, but sometime in the 2nd half of this year we will have a recession. Recessions last 3-4 quarters, been short as 2 quarters and as long as 10 quarters.

The fed is probably done raising rates, and we will have a rate cut by year end most likely.

Housing leads the economy out of a recession. It's first in, first out.

When the yield curve is inverted, you end up a recession. Yield curves are inverted

We are returning to where we were in the early 2000s from a mortgage rate perspective.

The baby boomers won't be willing to sell their property due to their low mortgages, slowing transactions. This happened back in the 1970s. The economics will make no sense to move because to buy the same house it would double their payments. When that happens, people just don't move. Mortgage rates will come down a but, but we will have a lack of supply on the market due to their mortgage rates.

The banking system is sound, and has had a high level of capital than it has had in the last 40 years.

Cost of financing autos have gone up, and it has put a damper on auto sales.

Median age of a millennial - 33.5+. They are the primary driver of new housing purchases. The reason the market slowed down so much is because they are the marginal buyer. Price went up significantly at the same time as the cost of money went up, and effectively priced them out of the market.

Prices will go sideways because we have a shortage of units, we are still not building enough single family homes, and as incomes increase and rates come down, it'll reignite the housing cycle and turnover will accelerate again.

Government has changed the inflation calculation method which causes inflation to be less than what is actually reported. It's about 3-5% higher than what the government is telling you.

We have not overspent on housing, we have probably underspent (single family homes), due to a huge deficit from the 08 crisis.

We need to spend more on single family homes and less on multifamily housing.

Investors invest the most in an asset class right at the top.

Over time the market will adjust to the higher mortgage rates, people will allocate a larger portion of their income to the mortgage and cut back on other things.

Renting is really related to the economic conditions. Demand for multifamily housing has turned negative recently. This is even before we have a recession and unemployment will go up. We expect this to come even more negative as more units come on the market.

Existing home sales spiked and then crashed. As the federal reserve lowers rates, we will recover back to the median level of sales.

Months supply of new homes is up. Permits have collapsed but deliveries have not. Deliveries are down 6% YTD, and that is different than what most people think about single family housing. Homes under construction are down 10-12% year over year.

Single family starts are back to where they were in 2019. as rates come down, starts will reaccelerate.

The recession will be fairly mild.

Housing affordability collapsed to the levels last seen in 2006-2007. This should recover somewhat as the fed lowers rates (but the data lags from the fed). This should improve as prices stay level, incomes will go up over time and catch up with prices.

Corporate profits are at record levels, corporate capital spending is starting to level out, retail inventories are starting to bump up due to over ordering due to the port problem. People ordered goods they didn't need once they all arrived.

Multifamily permits are as strong as they've been since the 1980s, starts are still very strong and there's still a lot of deliveries to come based on projects that are being constructed.

A lot of projects will be wipeouts, because they started before the fed started raising rates, so there's opportunities to buy these buildings from operators who are in trouble because their equity has been wiped out.

Multifamily investing did not have a pullback during the pandemic, it just went to new highs. There's a lot of projects in the works as there are certain states that are gaining people (florida and texas) and there is not enough housing for these transplants. NY's population is down 500,000 people over the last decade. Where the demand is, there's not enough supply and where we have supply there's not enough demand. So we will have the opportunity to buy buildings at very attractive prices.

Public construction spending has not grown enough, it's been the tail of congress's social spending dog.

The US infrastructure relative to other countries, sucks. The US needs to spend a lot more money on infrastructure.

Asset values are very expensive relative to history. There are issues going forward with asset values going up in real terms from here.

The valuation of the market is still as high as it was during the tech bubble. The returns won't be good at this starting level. Real assets will do better than stocks. Real assets are likely to outperform, housing should do fine over time.

The US is in a global economic fight with China and Russia. We are repeating what has happened before, the only difference is that economic policy has not caught up to the 60s-90s.

IMF projects China will be the largest economic power by 2030. The US may still be the #1 economy in the world by 2030.

The US dollar is currently overvalued.

Industrial real estate is something we should be looking at, as investment in this area has bottomed.

The way you make real money is to invest in assets that outgrow the economy.

Federal reserve controls the speed, the Federal government decides when to throw on the fire and which fire is going to get bigger.

Small business owner - owning businesses is the way to go. Owning real assets will be better than paper assets. Creating warehouse space, industrial space, or a small business of what's coming next that is more manufacturing oriented than its been in the 1990s.

Every decade is different, and what works in one decade may not work in another decade, you have to be careful.

Question as an agent: how do you position yourself to get key referrals?

How to win in this market as an agent: the real bit is having a presence out there in the marketplace and driving referrals or center of influence, key relationships to drive business back and forth.

Interested in connecting more, email jon@movewithmomentum. Onward - JB