The Market Has Changed, What You Need to Know

After studying finance, working on Wall Street, and opening several multi-million dollar businesses, I know how important it is to understand the economic trend.

Studying the trends and finding your position in that trend is incredibly helpful. I am sharing this information in hopes you may take a look at it, and consider it for yourself.

I am also concerned because we noticed other real estate brokerage leadership sticking their heads in the sand, causing their agents to suffer, while our company and agents are being proactive - saving them tens of thousands of dollars and positioning themselves to win now and in the future.

Don’t fall asleep at the wheel, like Ripley (my adorable pit mix).

If you’re interested in looking at the data, and seeing another perspective, keep reading. If you blank out at economic data or want to argue about it, you can… well, move along and skip this one :). Love you anyways.

So let’s jump in. Most importantly, since US GPD is 70% consumer spending, it’s most important to see how the consumer is doing in the United States.

Between DOGE, tariffs, interest rates and other economic conditions, we are starting to see a jump in job cuts and a decrease in job openings.

Consumers have heightened fear of losing their jobs.

This super blurry chart (you get the gist) shows a survey of expectations of personal finances hitting a historic low.

All income groups are reporting that their sentiments are dropping.

The average person basically has no savings.

Even the higher end consumers are pulling back.

Starting to see an upward trend in credit card loan defaults.

Credit card and auto delinquencies are seeing a spike upward, along with mortgage defaults.

Student loans are next.

These delinquencies and defaults are a problem because consumer credit is getting hit 50-150 points, making homeownership more out of reach, especially for first time home buyers who often have student debt.

The Trump administration recently said they’ll start collecting federal student loans starting May 4th, 2025….

Due to falling credit, we are seeing a spike in auto loan applications being rejected.

Overall - we are in a consumer debt bubble and delinquency is starting to show up more and more.

You may say, how is this much debt possible — the market has been absolutely incredible these last few years?

Well… the reality is the majority of people do NOT own any assets. The $ gained goes to those who already own assets in the top 1%.

So the consumer is not really in a good spot, and that carries over to housing.

Housing already has a massive affordability crisis.

Here’s another chart from another nerd, basically saying the same thing but upside down. Just for fun!

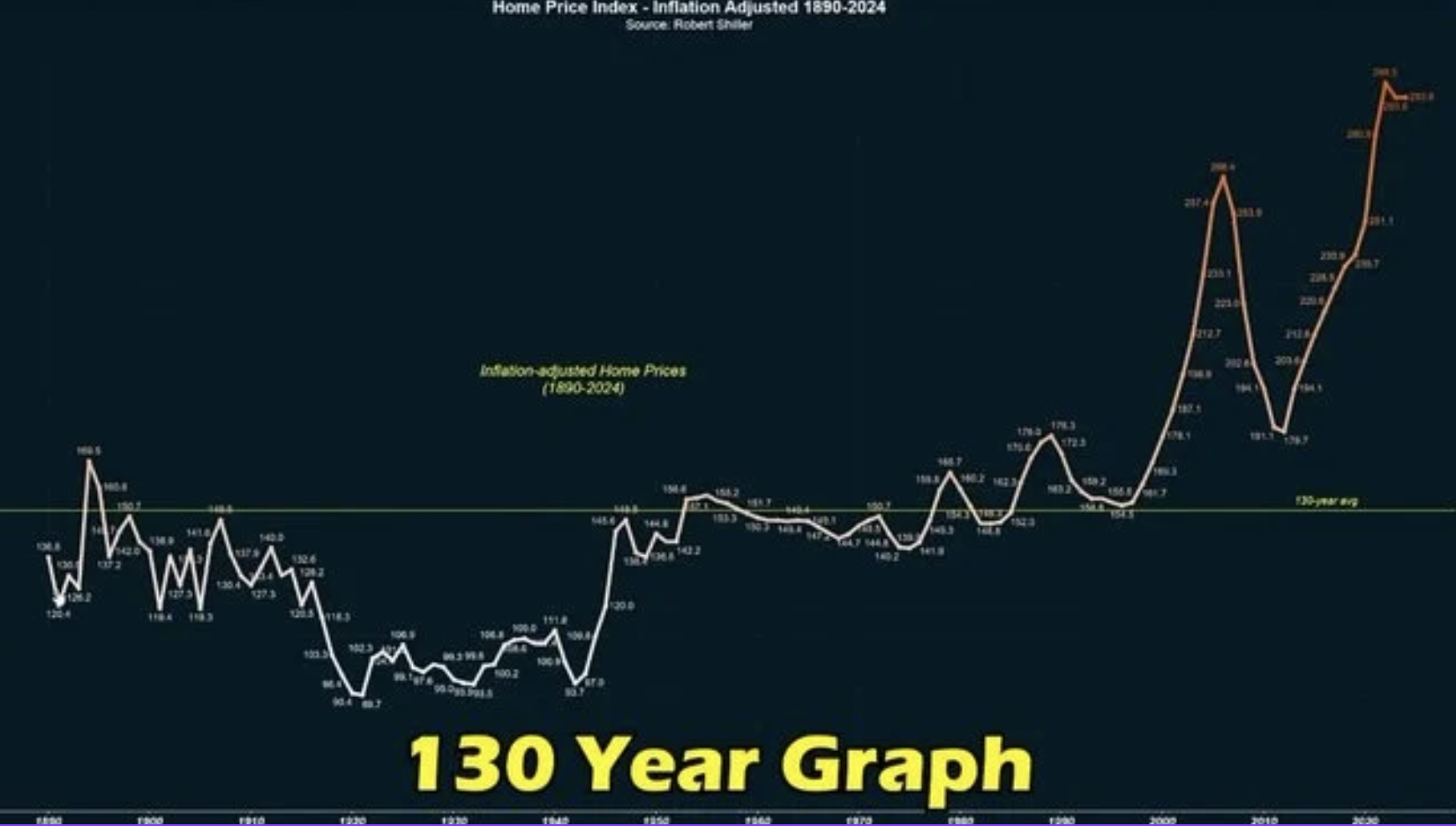

Here’s another blurry chart that shows the inflation-adjusted Home Price Index (if you are in real estate, and don’t know who Robert Shiller is, you need to — chatGPT him now).

But basically this chart shows that home prices are very dynamic, and go through multiple BOOM and BUST periods. This is nothing new.

Listings are starting to stack up due to overbuilding and consumer demand dropping (and investors stop buying).

Inventory stacking up from another view.

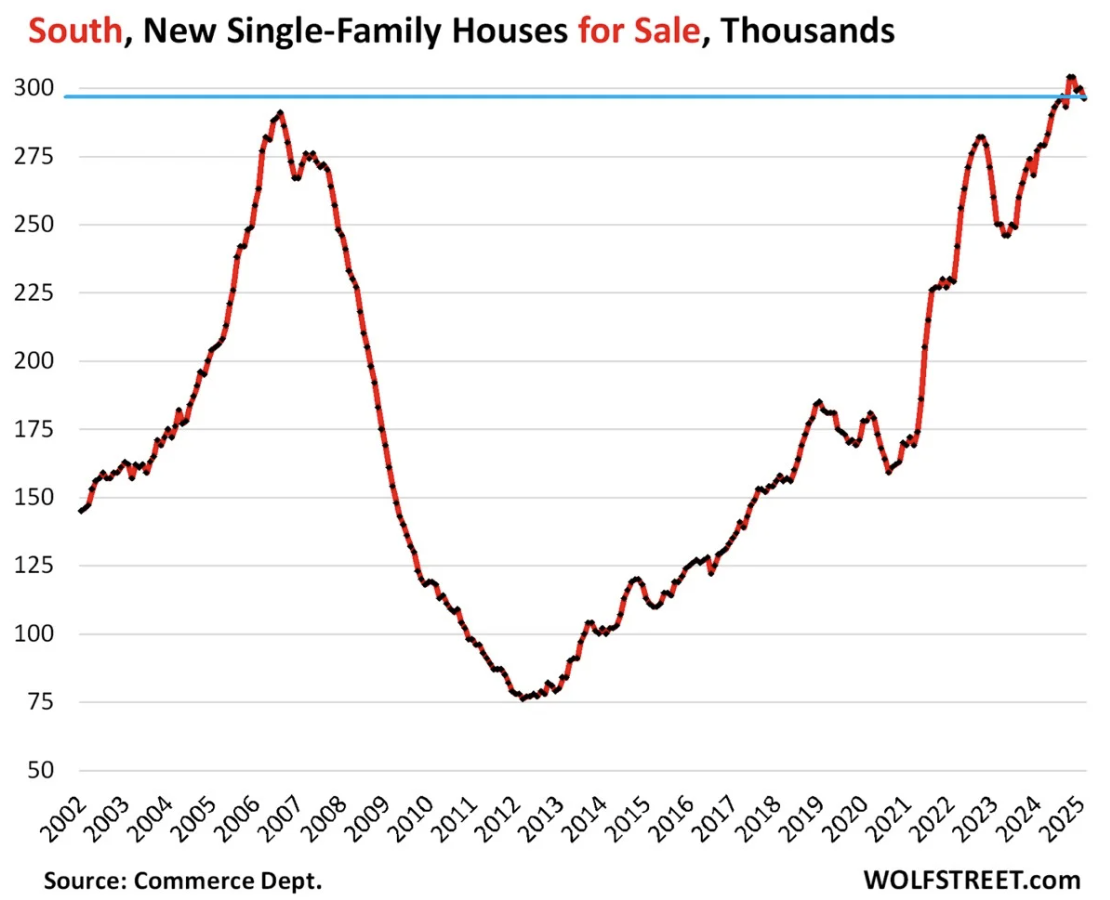

… And here’s a non-blurry chart that shows that new single family houses for sale are now higher than they were in the SOUTH than they were in the 06-07 bubble.

There was a prior narrative that there was a housing shortage (when really rates were just near 0)— well maybe this is true for AFFORDABLE housing, but not overall housing. When looking at population, it’s just not true.

So we are seeing now the number of existing home sales decline quickly.

And pending contracts are slowing too…

Yikes! This chart makes me sad as a real estate brokerage owner.

And basically telling the same story of slowing sales with this chart below.

And, of course, when you start seeing stupid slogans being thrown around, it’s an indicator that you’re near the end of a bull market and going into a new type of market environment.

Oh, did we mention there’s a spike in foreclosure starts lately?

FHA and VA loans are having big issues.

FHA delinquency is getting bad… it’s actually up to 15%+ now.

But that’s a US Govt program!

Ok - well then let’s just delete the data before anyone notices!

Too late, we noticed! 64.47% of borrowers have DTI ratios of greater than 43%! (did I mention consumers are LOADED up with debt?!)

… And when people start putting their burritos on credit while paying an extra $10 for door-dash because they’re too lazy to get off the couch to drive to get their meal, you know the consumer is completely tapped out and banks are just taking advantage at this point.

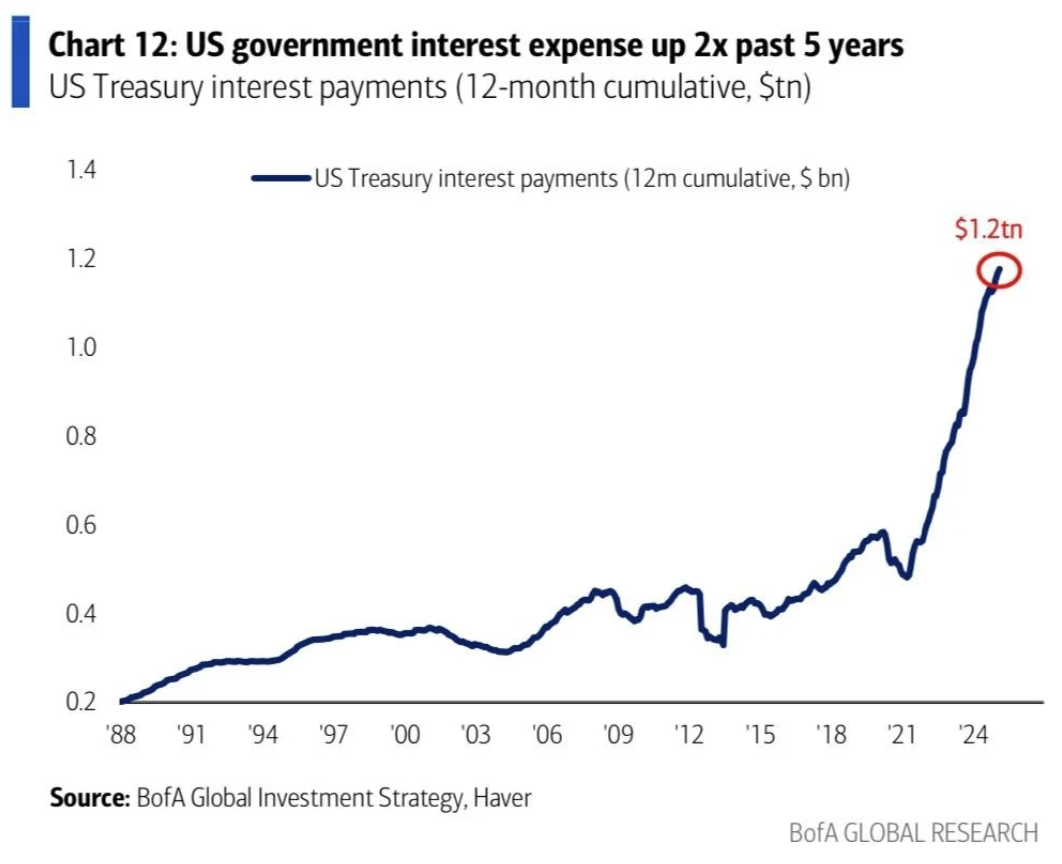

And for the finale, our US Govt is SO in debt and we have a lot of maturing debt that needs to be refinanced this year… at a higher interest rate.

So much so… that the US Govt has skyrocketing interest expenses…

Well, that was depressing!

But honestly, my perspective: opportunity is knocking. It’s all how you play the game and keep your mindset, which is a function of WHO you choose to spend time with (a bunch of whiners or a bunch of winners?).

In summary:

The US consumer is at record debt levels.

The US government is at record debt levels.

Housing prices just passed the peak and interest rates are higher, causing an affordability crisis that is making owning a home out of reach financially for many.

Housing inventory is stacking up in the South and areas that benefitted from COVID relocations. Note: every area is DIFFERENT, and real estate is hyperlocal. There are areas of the country that are still doing great. This commentary is in regards to FLORIDA , which is a retirement state and is way more dynamic and speculative.

Student loan payments are coming due and will impact first time home buyers now and in coming months.

Data is pointing to higher delinquencies, higher denials, and foreclosures (i.e. more inventory coming).

So, how you play the real estate game in this market?

That’s exactly what we talk about inside Momentum Realty, a top-tier real estate brokerage in Florida and Georgia for professionals who care about giving customers a 5-star experience and getting their life and business to the next level. Agents at Momentum care about health, lifestyle, profit, wealth building, and giving back. Our focus and higher standards have led us to grow our brokerage to a Top 10 Brokerage in under 5 years — all organically through referrals.

Want to learn more? visit movewithmomentum.com/join to connect, or email jon@movewithmomentum.com

#onechoicecanchangeeverything